How To Find Competitor Pricing

Content navigation:

- What is Competitive Pricing and Pricing Analysis?

- Why Is a Competitive Pricing Strategy Important for Pricing Analysis?

- How to Implement a Competitive Pricing Analysis

- 1. Determine Quality of Data

- 2. Define Data Parameters

- 3. Categorize Competitors

- 4. How to Do a Smart Pricing Analysis: Use Machine-Based Pricing Tools

- 5. Track Competitors' Online Activity

- Conclusion

What is Competitive Pricing and Pricing Analysis?

Competitive pricing analysis is an evaluation of the consumers reaction to new prices by means of research based on historical data or polls. Most often, price analysis examines customers' response to a price without considering the costs and potential profits for the business. After an initial price analysis is done, the team of pricing analysts uses the findings along with the other pricing factors to craft an optimal offering.

Competitive pricing strategy is a pricing policy based on the use of competitors' prices as a benchmark to set prices. This type of strategy is often referred to as competition-based or competitor-based pricing. In most cases, the business come to a competitive pricing strategy after a cost-plus approach turns out to be no longer relevant.

Why Is a Competitive Pricing Strategy Important for Pricing Analysis?

According to Forrester Consulting, 81% of buyers compare the offers of several stores in search of a better bargain. Retailers that can collect and analyze market data, map their position against competitors, and offer optimal prices are the companies that catch these buyers' eyes first and foremost.

Competitive pricing is a strategy which helps businesses attract more customers by optimizing prices using competitor product and pricing data. A successful pricing analysis can significantly increase sales, result in better cooperation with suppliers, and boost revenue.

How to Implement a Competitive Pricing Analysis

1. Determine Quality of Data

Complete and accurate data is crucial in order to analyze competitors. We surveyed our clients from several different countries to determine the following criteria as crucial to high-quality data:

- Depth of comparisons. Retailers need to take everything into account regarding product information: color, technical characteristics and other product attributes are vital for high-quality data, and are also not available on product cards.

- Percentage of errors. Most data matching is done using automation and is prone to a degree of error as a result. Manual comparison enhances automatic solution and ensures better results.

- The ratio of planned and delivered data. Data can be incomplete since the algorithm may lack information which is not available on the competitor's website. This means that the amount of data estimated before collection may exceed the amount of usable data that is delivered.

- Constantly updated data. Retailers should use the data collected no later than two hours before repricing.

- Data delivery time. Product and pricing data should be delivered to the retailer's internal system every 20-30 minutes to make comparison analysis more effective.

2. Define Data Parameters

Next, the company must determine important parameters of competitive data they need to want to collect and analyze for their pricing process. Just a few examples to illustrate what kind of parameters are typically monitored:

- Price Index. This displays the retailer's position in the market for a given product or class of products over a certain period of time. Price index visualizes how market dynamics affect sales and delivers data on prices listed by competitors.

- Competitors' promo activity. In the same study, Forrester Consulting indicated that at least a third of customers are trying to find discounts before buying an item. This means it is essential to continuously monitor discounts and sales of others in the industry to optimize promotional offers.

- Product availability. By monitoring competitors and their product stocks, retailers can adjust their prices based on the supply of an item or class of items on the market at a given point in time.

Many retailers think competitive pricing consists only of peer group analysis. However, competitive price analysis also requires a thorough study of internal company data (i.e. historical data) in addition to data revolving around competitors. It is impossible to set optimal prices and succeed with competition-driven pricing without having a profound knowledge of the market and your position in it as a retailer.

The outlined above parameters are just a small part of the data that can be monitored by retailers. Depending on business goals as well as logic and rules used while repricing, you can monitor any kind of data, e.g. stock levels, sales volumes, eCommerce traffic, promotions, etc.

3. Categorize Competitors

Once a retailer has thorough data about their competitors, the retailer needs to classify competitors according to several factors including but not limited to target audience and product quality. There are three main categories that market competition can be divided into:

- Primary — direct competitors who pursue the same buyer category.

- Secondary — competitors who focus on upscale/downscale versions of the retailer's assortment. Analyzing secondary level competitors allows businesses to develop a broader idea of their place in the market and boost their strategic skills accordingly.

- Tertiary — companies selling products which are indirectly relevant to those of the retailer. Analyzing this level of competition helps retailers willing to expand their assortment.

Categorizing competitors makes market analysis less time-consuming and allows retailers to focus their attention in the right direction in terms of competition.

A data-driven approach could also be applied while defining and categorizing the competitors. If you are a mono-brand retailer or sell a very limited number of SKUs, you'd probably be able to categorize competitors manually. But for large sellers with thousands of products offered across different pricing zones, the smart competitors' analysis has no alternative.

Beyond that, the competitive landscape for each product is not stable as other retailers change their strategy and new players enter the market. What it means is that the competitive analysis and categorization are ongoing processes that should be done more or less often depending on the product type or market segment.

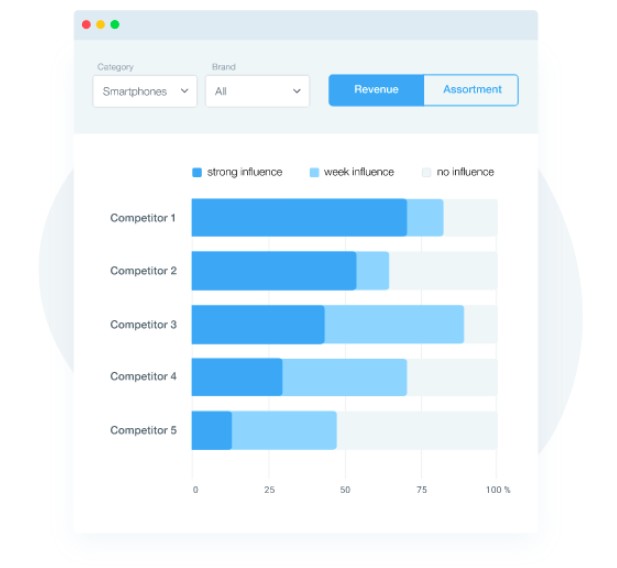

To cover this need, Competera offers a so-called 'True competitors' module enabling retailers to find the real impact every player has on particular SKU sales by analyzing retailer's and competitive historical data.

4. How to Do a Smart Pricing Analysis: Use Machine-Based Pricing Tools

Modern retail companies are increasingly leaning towards algorithms to collect and analyze data. Machines have significant benefits over manual approaches:

- Improved accuracy

- Can process large amounts of complex data

- Scheduled delivery

- Provide precise pricing recommendations.

Arguably, the most important aspect of implementing automation into the pricing process is that it allows retail teams to switch from routine tasks to strategic tasks regarding pricing strategy and price management.

When it comes to automated pricing systems' implementation, most retailers are afraid of extra costs. The fact is that these solutions are instead a means of cost reduction. For example, Wiggle CRC managed not only to reduce the repricing time by 50% but also got a full view of the market at lower costs. The latter was achieved mainly through monitoring marketplaces instead of competitors' websites.

If you want to get more tried and tested tips on reducing competitive data monitoring costs, watch the video below.

5. Track Competitors' Online Activity

To have a better understanding of the market, retailers should monitor their competitors and their platforms such as official websites and social media accounts. There are several aspects businesses need to examine:

- Product descriptions

- Visual presentation

- Social media activity

- If the websites and social media accounts are mobile-friendly

- Customer support and feedback options

- Response rate

In addition, retailers can sign up for official newsletters and become a follower of their competitors on social media. Businesses need to understand what attracts clients to their competitors' products.

These are several examples of how retailers can benefit from open source information. The more key points they identify and analyze, the better their information will be to base important pricing decisions on.

Conclusion

Creating a competitive pricing strategy from scratch is no easy feat. Many factors revolving around data, such as parameters and quality, must be carefully considered. Companies must decide whether they will utilize automation within their pricing process and if so, to what extent. Lastly, they also must thoroughly study their competitors to obtain a better understanding of their place in the market in order to truly excel in it.

How To Find Competitor Pricing

Source: https://competera.net/resources/articles/competitive-pricing-analysis

Posted by: myersgrell1966.blogspot.com

0 Response to "How To Find Competitor Pricing"

Post a Comment